What is Amortization?

Amortization is an accounting technique used to gradually reduce the book value of a loan or intangible asset over a set period of time. The purpose of amortization is to match the cost of the asset to the revenue it generates over its useful life [1].

Unlike depreciation, which is used for tangible assets like property, plant and equipment, amortization applies to intangible assets like patents, copyrights, trademarks, and goodwill [2]. While depreciation expenses an asset's declining usefulness, amortization expenses the consumption of an intangible asset's value.

Amortization spreads out the cost of an intangible asset over multiple accounting periods. This process lowers net income in the earlier years and increases it in the later years. As a result, amortization impacts a company's balance sheet by gradually decreasing the reported value of intangible assets [1].

Amortization of Loans

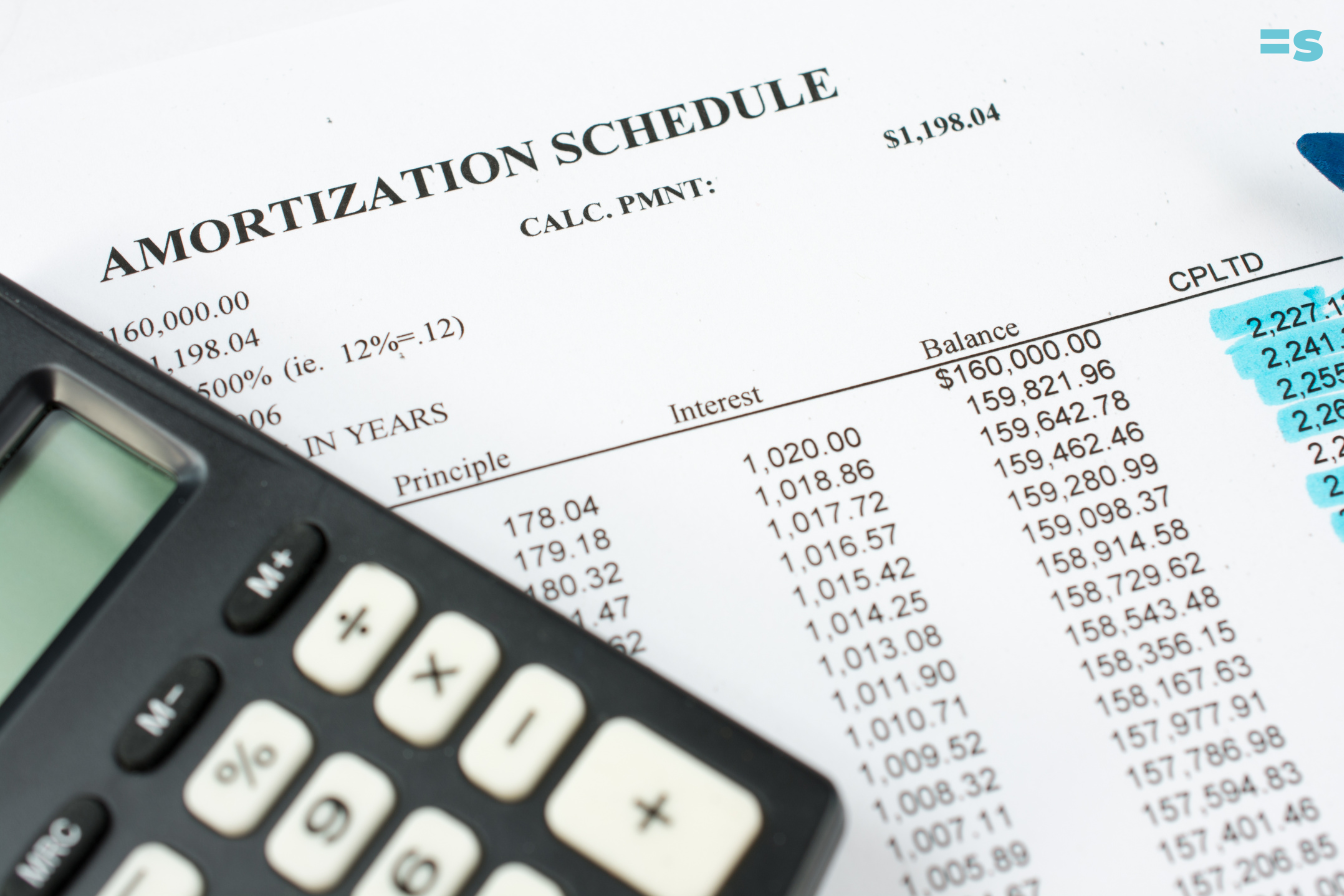

Amortization is commonly used for loans like mortgages and car loans to pay down the balance over a set period of time. With an amortized loan, the payments are structured so that each one pays both principal and interest (1).

The amortization schedule lays out the full repayment timeline, showing how much of each payment goes towards interest vs principal. In the beginning of the loan term, the interest portion is larger because interest accrues on the outstanding principal balance. As the principal is paid down over time, the interest portion gets smaller and more of the payment goes to principal (2).

For example, a 30-year fixed-rate mortgage for $200,000 at 4% interest would have a monthly payment of around $955. In the first month, $666 would go towards interest and $289 towards principal. But by month 360, only $152 would go to interest and $803 to principal (3).

Amortization allows the borrower to slowly pay off the loan over time. It results in the loan being fully paid off by the end of the term, as long as all payments are made on schedule. The amortization structure helps make large loans like mortgages more affordable.

Types of Amortized Assets

Both tangible and intangible assets can be amortized for accounting purposes.

Tangible assets that are commonly amortized include buildings, equipment, furniture, fixtures, and vehicles used in business operations. These fixed assets have a limited useful lifespan and lose value over time through wear and tear. Amortization allows businesses to allocate the cost of acquiring tangible assets over their estimated useful lives.

For intangible assets, only certain types with finite useful lives are amortized. Examples include patents, copyrights, licensing agreements, franchises, and trademarks. Goodwill and brand recognition are considered intangibles with indefinite lives that are not amortized. The costs of intangible assets with limited lives are expensed through amortization over the periods expected to benefit from them. Proper amortization of intangibles is important for accurate financial reporting.

The key difference between amortization of tangibles versus intangibles is the nature of the assets. Tangible assets derive value from physical properties and wear out over time. Intangibles derive value from legal rights or competitive advantages, which may expire after a certain period.

Determining the Amortization Period

The amortization period refers to the amount of time over which an asset's cost is allocated and expensed on the income statement. There are several key factors that influence the length of the amortization period for a given asset:[1]

- Useful life of the asset - The amortization period is typically set based on how long the asset is expected to generate economic benefits. Assets with longer useful lives have longer amortization periods.

- Industry standards - Some industries have standard amortization periods for certain asset classes that are commonly followed. These help ensure consistency.

- Accounting regulations - Accounting rules and standards often dictate maximum amortization periods for different asset categories. Companies must comply with these standards.

- Nature of the asset - Intangible assets like patents tend to have shorter useful lives and amortization periods than tangible assets like buildings. Their nature impacts the amortization treatment.

- Obsolescence - If an asset is at risk of becoming obsolete quickly, the amortization period may be shorter to account for that increased risk of diminishing utility.

- Company policy - Some companies choose to amortize assets more aggressively than their useful lives suggest. Shorter periods reduce tax liability but increase expenses.

The amortization period is a key estimate that can significantly influence a company's financial statements. Companies aim to match the amortization period with the asset's underlying economics as closely as possible.

Accounting Treatment and Impact

Amortization expense is recorded in the accounting books through an entry that debits amortization expense and credits the accumulated amortization account associated with the intangible asset [1]. This reduces the net book value of the intangible asset over its useful life.

On the income statement, amortization expense is recorded as a deduction from revenues, so it decreases the reported net income. On the balance sheet, accumulated amortization is presented as a contra account that reduces the gross intangible asset account [2]. Thus amortization decreases both the asset value on the balance sheet, as well as net income on the income statement, over the amortization period.

Proper amortization accounting is crucial to accurately reflect the consumption of intangible assets and match expenses to the periods in which assets generate revenues. Companies must carefully estimate useful lives and amortization periods when initially recording intangible assets.

Amortization Methods

There are several common methods used to calculate amortization schedules. The most popular are straight-line amortization, declining balance amortization, and the sum-of-the-years' digits method [1].

With straight-line amortization, the amortization expense is spread evenly over the life of the asset. This results in equal amortization amounts each period. For example, if an asset costs $10,000 with a 5-year useful life, the straight-line amortization would be $2,000 per year ($10,000/5 years).

Declining balance amortization allocates higher amortization expenses to earlier periods, with the expense declining over time. Typically, a multiple of the straight-line rate is applied each period. For example, double declining balance would amortize at twice the straight-line rate each year. This accelerates the amortization compared to the straight-line method.

The sum-of-the-years' digits method calculates amortization based on a weighted average useful life. The amortization fraction is determined by dividing the remaining useful life by the total useful life. This also results in higher amortization in earlier years that declines over time.

Each method impacts a company's financial statements differently. Companies select the method that best aligns with the anticipated economic benefits of the asset. Proper accounting rules and regulations must be followed regardless of the amortization method selected [2].

Calculating Amortization

Amortization is calculated using a simple formula that spreads out the cost of an asset over its useful life. Here are the key steps for calculating amortization expense [1]:

- Determine the initial cost or basis of the asset. This is the amount that will be amortized.

- Estimate the salvage value or residual value - the amount the asset is worth at the end of its useful life.

- Determine the useful life of the asset in months or years. This is the amortization period.

- Subtract the salvage value from the initial cost to determine the total amount to be amortized.

- Divide the total amount to be amortized by the amortization period. This gives you the periodic amortization expense.

For example, if a patent cost $20,000, has a useful life of 10 years, and an estimated salvage value of $2,000, the amortization expense would be calculated as:

- Initial cost: $20,000

- Salvage value: $2,000

- Total to amortize: $20,000 - $2,000 = $18,000

- Useful life: 10 years (120 months)

- Monthly amortization = $18,000/120 = $150

So the monthly amortization expense for the patent would be $150. This $150 will be recorded in the company's income statement each month as an operating expense for the patent [2].

The amortization formula can be adapted for different time periods by adjusting the useful life. For instance, if a company wants to calculate quarterly amortization, the useful life would be 40 quarters rather than 120 months.

Amortization vs. Depreciation

Amortization and depreciation are two important concepts in accounting that represent methods for allocating the cost of assets over time. However, there are some key differences between amortization and depreciation:

- Amortization applies to intangible assets like patents, trademarks, copyrights, franchises, licenses, etc., whereas depreciation applies to tangible, physical assets like buildings, equipment, vehicles, etc. [1]

- Amortization is recorded as an operating expense on the income statement, while depreciation expense is listed separately below the operating expenses section.

- The amortization period depends on the useful life of the intangible asset, while depreciation schedules are based on IRS guidelines and tax policies.

- Amortization uses the straight-line method in most cases, while different depreciation methods can be used like straight-line, double declining balance, etc.

- Amortization expenses tend to stay relatively constant over the life of the intangible asset, while depreciation is often front-loaded with expenses decreasing over time.

- Disposal of an amortized intangible asset can result in a gain or loss, while disposal of a depreciated tangible asset always results in a gain or loss.

- Testing intangible assets for impairment is an important part of amortization, less so for depreciation.

So in summary, amortization is for intangible assets while depreciation is for tangible assets, and they have differing accounting treatments and methods. But both represent allocating asset costs over time.

Managing Amortized Assets

Companies need to actively manage their amortized assets to maximize their useful lives and value. This involves:

- Monitoring amortization schedules and ensuring they align with expected asset usage and lifespans. Schedules may need to be adjusted if asset usage changes significantly [1].

- Reviewing amortization periods periodically and making adjustments if asset lifespans are extended through maintenance, upgrades, etc. Useful asset lives can often be prolonged through proactive management [2].

- Tracking asset usage and performance data to identify underutilized assets that may be candidates for disposal or redeployment 3.

- Handling asset disposals properly from an accounting perspective. Any remaining unamortized asset value must be written off appropriately.

- Planning for asset replacements and acquisitions as current assets near the end of their useful lives. New assets should be amortized according to current accounting policies.

Proper ongoing management of amortized assets ensures companies accurately reflect asset values on financial statements while maximizing their operational usefulness.

Special Considerations for Amortization

Amortization can have important implications when it comes to taxes. The amortization expense is tax deductible, which can provide valuable tax savings for companies [1]. However, the rules around deducting amortization expenses can be complex and vary based on the type of asset and applicable regulations. Consultation with a tax professional is advisable when claiming amortization deductions.

For intangible assets like patents, trademarks, and copyrights, the rules for amortization differ from tangible assets [2]. Generally accepted accounting principles (GAAP) provide specific guidance on determining useful lives and amortization methods for major classes of intangible assets. Adhering to these standards is necessary for proper accounting treatment and financial reporting of intangible asset amortization.

Changes to accounting standards and regulations can also impact amortization calculations and reporting. Companies must closely monitor bodies like the Financial Accounting Standards Board (FASB) and SEC for new pronouncements that may alter amortization rules. Transitioning to new standards requires adjustments to amortization schedules and disclosures to maintain compliance and consistency. Advanced planning and review of proposed changes is key to smooth adoption of evolving amortization guidelines.